How Much Does It Cost to Rebuild a Toyota Engine

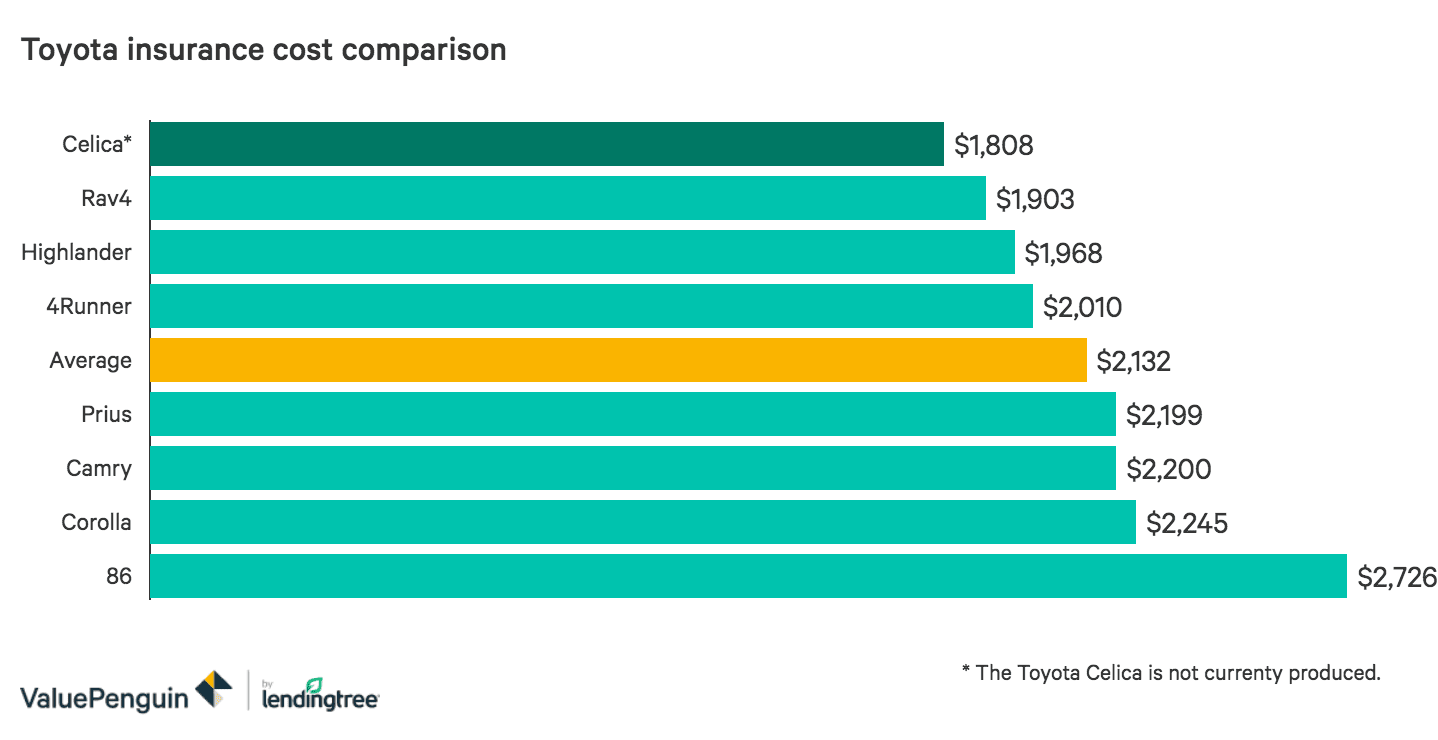

The cost of Toyota insurance is $2,132 per year on average across the eight models we considered in our survey. However, prices can vary dramatically depending on which Toyota you are insuring, where you live, your age and your driving history. To find the cheapest rates when looking to insure your Toyota, it is best to compare rates from multiple insurance companies.

- Toyota insurance rates: by model

- Corolla

- Camry

- Rav4

- 86

- Prius

- Highlander

- 4Runner

- Celica

- Toyota lease insurance

Toyota insurance rates: by model

Of the Toyotas we surveyed that are currently in production, the vehicle with the cheapest insurance rate, the Toyota Rav4, costs $1,903 per year to insure — which is 30% cheaper than the $2,726 annual premium for the Toyota 86, the most expensive model.

Find Cheap Toyota Auto Insurance Quotes

Toyota Corolla insurance cost

Insurance for the Toyota Corolla costs $2,245 per year on average across the six model years we considered, for our adult male profile driver's full coverage car insurance policy. This rate is only slightly greater — it is 2% more per year — than the cost of identical coverage for a Toyota Camry. However, young drivers can expect to pay much more for coverage, as we found that average annual premiums for 18-year-olds to be $8,429.

On average, insurance for newer Corollas is more expensive than it is for older models, with the 2019 model costing 11% more for our 30-year-old driver and 33% more for our 18-year-old driver compared to the cost of coverage for 2014 model. This difference in premiums is largely due to the more expensive comprehensive and collision coverage, which pay to repair or replace your vehicle in a covered accident, due to the fact that newer cars are typically more expensive to replace.

Toyota Camry insurance costs

Car insurance for a Toyota Camry costs $2,200 per year on average across the last six model years according to our research, which included quotes for an adult male driver. Younger drivers, such as 18-year-olds, can expect to pay more than 3.5 times that much for an identical policy — with annual premiums ranging from $6,855 to $8,782 depending on the year.

Of the Toyota models that we considered, the Camry has some of the highest insurance costs — with average rates for our 30-year-old profile-driver being 16% higher than they are for the Rav4. This translates to a cost difference between the two Toyotas of about $300 per year.

Toyota Rav4 insurance cost

Our survey of quotes revealed that auto insurance for the Toyota Rav4 costs, on average, $1,903 per year for older adult drivers and $6,951 for young teen drivers. This rate ranks as the cheapest for our 30-year-old male profile drivers, among the Toyotas that are currently in production and were included in our study. Furthermore, we have previously found this car to be one of the cheapest cars to insure on the market today.

Rav4 insurance rates are very similar to that of the Toyota Highlander — another Toyota SUV — with the annual premium difference between the two vehicles being around $70 for both our teen and adult driver profiles.

Toyota 86 insurance cost

We found that insurance for the Toyota 86 — previously marketed as the Scion FR-S — is priced at $2,726 and $10,016 per year for our 30-year-old and 18-year-old profile drivers respectively. These rates make the 86 the most expensive to insure among the Toyota models we surveyed.

The high costs of insurance for this vehicle is most likely due to the fact that — as a sports car — the Toyota 86 is statistically at a higher risk to be stolen or in an accident, than a typical sedan or SUV. To account for this increased risk, insurance companies raise the price of auto coverage for drivers.

Toyota Prius insurance costs

Our survey of quotes found that Toyota Prius insurance rates average $2,199 per year for our adult male profile driver. Insurance rates for the Prius varied by $29 and $184 per month across model years for our 30-year-old and 18-year-old drivers respectively.

Among the Toyotas we considered, the Prius' insurance rates are on par with average for both the adult and teen driver profile.

Toyota Highlander insurance costs

The quotes we gathered showed that the average Toyota Highlander insurance cost is $1,968 per year — or $164 per month — for our 30-year-old male profile driver. However, we also found that teen drivers can expect to pay about 3.5 times as much for an identical full coverage policy.

Insurance costs for the Highlander are only slightly more expensive — a difference of less than $70 per year — than the average premiums for the Rav4. This is somewhat surprising considering that the Highlander has an MSRP 24% greater than that of the Rav4. Furthermore, we have previously found that standard size SUVs, such as the Highlander, are typically much more expensive to insure.

Toyota 4Runner insurance cost

The cost of Toyota 4Runner insurance is $2,010 per year on average for our 30-year-old male profile driver across the model years we considered. Additionally we found that the 2017 model to have the highest insurance rates among the 4Runners produced from 2014 to 2019, with an annual cost of $2,177.

Toyota Celica insurance cost

We found that insurance for a 2000 Toyota Celica costs $1,808 per year on average for our adult male driver. However, Toyota Celica insurance for 18-year-olds is much higher, with annual premiums costing $7,313.

Compared to the other Toyotas we surveyed, the Celica's insurance rates are expensive relative to its cost. Despite the fact that the market value of a 2000 Toyota Celica is only 9% of the list price of a new Highlander — $2,794 compared to $31,680 — insurance costs for 18-year-olds are actually $215 per year cheaper for the latter. This is likely because a Toyota Celica is considered a sports car for insurance companies, which are typically seen as more risky to cover.

Toyota lease insurance

Drivers that lease a vehicle from a Toyota dealership are required to have the minimum liability coverage required by your state, as well as physical damage insurance with a maximum deductible of $1,000. The physical damage coverage requirement can be fulfilled by opting for comprehensive and collision coverage, which is a standard offering for major insurers that covers your car if it is damaged or stolen.

Those leasing or financing a vehicle purchase should also consider Toyota GAP (Guaranteed Auto Protection) insurance, which kicks in if — in the event of a total loss — your primary car insurance policy pays out less than you owe on the vehicle. This scenario is common with new vehicles that depreciate rapidly.

For example, say you buy a new Highlander for $31,680. After one year its market value is $25,000 and you owe $28,000 on it. If you were to total your vehicle, a Toyota GAP insurance policy would cover the $3,000 difference between what your primary auto coverage would pay ($25,000) and what you owe on the car ($28,000).

While Toyota GAP insurance — which is offered by Toyota Financial services — can be a good addition to an insurance policy on a new or leased vehicle, you may be able to find cheaper gap coverage with a standard insurer. Companies such as Allstate, Farmers and Travelers should all be able to offer you this type of coverage.

Methodology

Our sample of rates represent the cost of a full coverage policy, with liability limits above the state minimum. Quotes were collected for two sample drivers:

- Adult profile: 30-year-old male

- Teenage profile: 18-year-old male

Both profile drivers lived in San Antonio and had clean driving records with no traffic violations or accidents.

How Much Does It Cost to Rebuild a Toyota Engine

Source: https://www.valuepenguin.com/toyota-car-insurance